Fine wine and whisky have some of the most reliable and consistent profit margins of any market. While stocks and shares see unpredictable highs and lows, wine and whisky tend to have less volatility plus the potential for great returns.

Wine consumption and demand have grown exponentially over the last four decades, and whisky has seen a sudden increase in demand over the last 15 years.

The fine wine and whisky markets have outperformed many global equities and exchange-traded funds, showing less volatility for example than real estate and gold. Luxury assets such as wine and whisky tend to always be in demand regardless of global economic circumstances, as the consumers of such luxury assets usually have sufficient funds to be somewhat protected.

Here are a few pointers to consider when contemplating investing in fine wine or whisky:

Do Your Homework

Knowing the industry well is important. Take time to research the performance of notable distilleries, the market in general and which bottles are most in demand. A knowledge of the broader market will help you spot opportunities more confidently and make sensible investments.

For a wine or whisky to be labelled ’investment grade’ it needs to be of the highest quality and made by the most acclaimed producers. Investment quality is determined by brand recognition, resale value, heritage, critical acclaim and its propensity to age well. Investment-grade wines and whisky account for only around 1% of total annual production.

Identify Your Investment Timescale

Wine and whisky are generally not short-term investments. Ideally you should be anticipating a minimum investment period of at least five years.

Some wines and whiskies will be more suitable for shorter-term holds, whereas others will show much greater appreciation over a 10 year period.

Choose Your Investor and Investments Carefully

Wine investment is an unregulated market, so it’s vital to work with a broker or company with an excellent track record and reputation.

Typical annual returns from wine investment are 10-15%, so be wary of anyone promising fantastic returns without hard evidence.

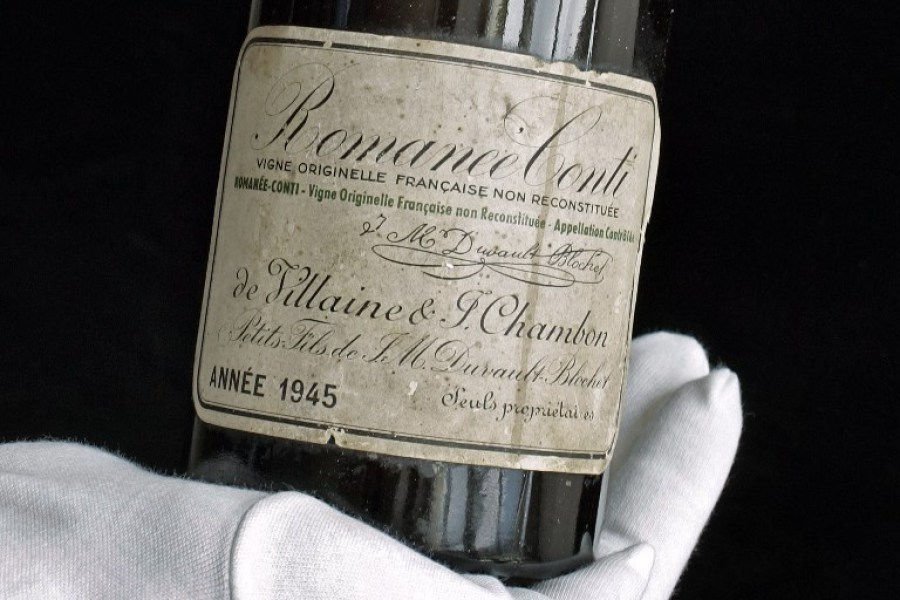

Not all wines and whisky are investment opportunities. For example, if you want to invest in wine, the most famous investment-grade wines like Domaine de la Romanee-Conti or Sasscaiai can cost thousands of pounds. These “blue chip” wines can show growth of 150 – 200% over a five-year period and are exceptionally popular among collectors.

But there are also many undiscovered gems from emerging wineries, such as the USA, Chile, Argentina and Australia. The key is often to look for lesser-known wineries with a growing reputation and increasing demand – these are the up-and-coming superstars of the wine world.

Be Cautious

As scammers see the demand for rare bottles of wine and whisky rise, fake bottles are becoming increasingly widespread. According to the world’s leading experts on wine fraud, there is currently around $4bn worth of counterfeit wine worldwide.

Always seek a second opinion and wherever possible buy only directly from vineyards or trusted and proven brokers or merchants. High quality brokers and companies will provide you with authenticity certificates and guarantees.

Secure storage

Correct storage is essential for peak-quality maintenance and makes wines and whisky more attractive to potential buyers. The best scenario is for wine to go straight from the vineyard into secure storage so that the potential buyer has proof of the conditions under which the wine has been kept and aged.

Wine should be stored in optimum temperature, humidity and light conditions. For bottles bought solely for investment purposes the bottle shouldn’t be opened under any circumstances as this will drastically decrease the value. Whisky and wine bottles should also be stored upright to avoid contact between the cork and the liquid inside.

Consider Your Exit Options

The key to realising investment returns on wine and whisky is to have a solid and profitable exit strategy.

There are several exit strategies when it’s time to sell wine and whisky; these range from selling at auction, trading on a global marketplace such as Liv-ex, selling directly to private consumers or collectors, to selling to merchants and the retail sector such as Michelin-starred restaurants and top hotels and bars.

The photo above features a bottle of Domaine de la Romanee – Conti Grand Cru 1945, a burgundy which sold at an auction in Geneva for $558,000, making it the most expensive aged wine in the world.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.